As a result, traders need to be careful not to jump into a stock just because it has formed a bull flag; instead, they should wait for confirmation of the uptrend before buying. A flag pattern is a trend continuation pattern, appropriately https://forexhero.info/zulutrade-overview/ named after it’s visual similarity to a flag on a flagpole. A “flag” is composed of an explosive strong price move that forms the flagpole, followed by an orderly and diagonally symmetrical pullback, which forms the flag.

What is a Brahma? San Antonio’s new XFL mascot explained – mySA

What is a Brahma? San Antonio’s new XFL mascot explained.

Posted: Tue, 01 Nov 2022 07:00:00 GMT [source]

As mentioned earlier, the bull flag is a continuation pattern. Therefore, we are looking to identify an uptrend – the series of the higher highs and higher lows. The second step in spotting the bull flag pattern is monitoring the shape of the correction.

Flat Top Breakout Pattern

Bull flags, like most continuation shapes, represent a bit more than a shorter lull in a bigger move. Hence, they usually form in the middle of the final move. Moreover, they occur as assets/stocks hardly move higher in a straight line for a long period because these moves are broken up by shorter periods.

Learn about the rise of decentralized finance (DeFi) platforms, why they’re becoming so popular, and potential challenges. Sign up for my free watchlist to learn my process behind watching stocks. With this pattern, buying the breakout is the easy part. Inflation can have a big impact on the stock market, leaving unprepared investors in for a bumpy ride.

Bull Flag Pattern

Traders who use technical analysis will study chart patterns such as the bull flag formation when looking for a long trade set-up. Simpler Trading has mastered the art of technical analysis. Our traders perform live technical analysis in our trading rooms. If you’re new to trading, consider joining the free trading room. If you have a few years of experience, you can take your trading to the next level by joining our options gold room. Once the price breaks out of the consolidation phase, it signals that the uptrend is likely to continue.

However, what they might not see is that on the 30-minute chart, the price is trading sideways, limiting potential upside. Following all impulsive moves in the market is either a stark reversal or a period of consolidation. The flag of this pattern is such consolidation and is what you will be looking for to find this pattern. The flag, which denotes a consolidation and gradual reversal of the uptrend, should preferably be formed with low or dropping volume. This indicates a lack of excitement for the counter-trend move. The flag, which signifies a consolidation and gradual reversal of the downtrend, should preferably be formed with low or dropping volume.

Pros and Cons of a Bull Flag Pattern

CF International Inc.’s price chart is a great example of a really tight flag. Often, the tighter flags perform best, and they also offer easier stop-loss levels. Bull flags usually resolve one way or the other in less than three weeks.

- Read on to learn what the bull flag pattern is, how to use it, and real-world examples.

- If you only want to trade bull flags and there’s no bull flag then … just stay away.

- Another scenario that fuels bull flags are short squeezes.

- The bear flag is a countertrend consolidation in a downtrend.

- Therefore, we are looking to identify an uptrend – the series of the higher highs and higher lows.

Further, waiting for the end of the flag’s trend allows a greater risk-to-reward ratio and a greater probability of profit. It may be tempting to try and guess the bottom of the price channel, and time the last bottom before the next impulsive jump. However, the market may simply continue the flag price channel for one more leg, or many more than one. This is why traders wait for the breakout in the flag pattern, rather than jumping in and making trades based on hope. Traders hoping for a bear flag formation will look for high or growing volume into the flagpole (trend which precedes the flag). Enhanced or above-average volume accompanying the downtrend (flagpole) indicates increased sell-side interest for the underlying asset.

Combining Bull and Bear Flags With Other Indicators

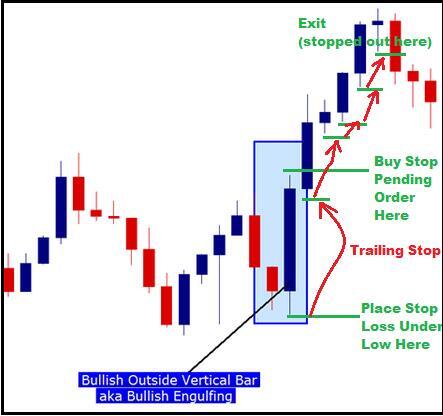

It forms when the price retraces by going sideways to lower price action on weaker volume followed by a sharp rally to new highs on strong volume. Traders favor this pattern because they are almost always predictable and true. The price chart from Answers Corp. below is a nice example of a bullish flag that may be breaking out.

- Enhanced or above-average volume accompanying the downtrend (flagpole) indicates increased sell-side interest for the underlying asset.

- The resistance levels remain as high as the flag pole and create a horizontal line across the top.

- You can use a buy stop order to make sure that you get it at the price you want.

- Past performance of a security or strategy does

not guarantee future results or success. - It is termed a flag pattern because it resembles a flag on a pole when seen on a chart, and since we are on an upswing, it is considered a bullish flag.

The bull flag pattern is a bullish continuation chart pattern that signals the likely extension of an existing uptrend to higher prices. Its counterpart is the bearish flag pattern that signals the continuation of an existing downtrend. Technical analysis traders use price action patterns such as a bull flag to identify low-risk market entry price levels for day trading, swing trading strategies. Stock chart apps support a wide range of technical analysis features like charts, pattern recognition and drawing tools. A bull flag resembles a flag that is flying in the wind.

Trading bull and bear flags with volume patterns

A technical analysis pattern called the bull flag is a recognized price pattern and is thought to indicate that a price increase is about to occur. No other platform can alert you to breaking news and price action as quickly as StockToTrade. The bull flag and bear flag represent the same chart pattern however, just mirrored. In a bear flag scenario, a strong decline in price is followed by seller consolidation near the move’s lows. This is quite bearish since buyers are unable to bring the price back to its previous level. Rather than that, sellers continue to add to a position.

What is the F1 cost cap? Latest on Red Bull’s breach and potential … – Motor Sport

What is the F1 cost cap? Latest on Red Bull’s breach and potential ….

Posted: Fri, 21 Oct 2022 07:00:00 GMT [source]